Even though the coronavirus pandemic continues to demonstrate trends of improvement, the economy remains slow to start. States are opening at a slow pace, leaving many small businesses, the heartbeat of this country, wondering when and how they will have their opportunity to open their doors, service customers, and fight to survive after years of struggling to build their achieved success, prior to this economic crash.

Here are some techniques I’ve incorporated into our strategy at B2B Soft that have been successful, and that I would like to share with you.

1. Apply for Grants and Loans, and take advantage of the PPP loan forgiveness program

The Paycheck Protection Program (PPP) is a loan that will provide funds to your business for the purpose of maintaining employees on your payroll. The SBA has indicated that for those businesses who maintain employees on their payroll for 8 weeks or longer, and where the money is used exclusively for payroll, utilities, rent or mortgage interest, the loans will be forgiven.

For additional information, including the SBA guidelines and assistance in finding a PPP lender, click here.

When working with loans and financial institutions, you may have better results working with your smaller community banks as opposed to working with the big institutions. Local banks are a part of your local ecosystem, tend to have a vested interest in the positive impact of your survival and success, and therefore may be more apt to support your needs.

2. Speak with your accountant on how to best manage the 2020 tax filing extension

As you likely know and in response to the Coronavirus outbreak, the IRS is providing special tax filing and payment relief to businesses, by extending the filing date to July 15, 2020. If you are due a refund however, the IRS is encouraging businesses to file as quickly as possible in order to obtain this refund for working capital into your operation.

If you are like many businesses and you owe money for your taxes, this 90-day deferral is free of interest and penalty and is the perfect opportunity for you to do what you need to do in order to survive these times.

Consult your accountant and obtain the proper guidance for doing what’s best for your business. If it helps to avoid surprises, click here for a list of published filing deadlines.

3. Use this downtime to refocus and realign your financial strategy

Even if you are still within your first year of business, you already realize that plans are meant to send you on your path, but as circumstances change you will need to rethink (and rethink) your financial model and strategy. A solid approach to help test the current viability of your financial plan is by using a 6+6 budget, where you take 6 months of actual data and 6 months of forecasted budget data, and create a working model. The power of this approach is you are able to build off of your actual performance and continue forward with your plans based on your latest execution.

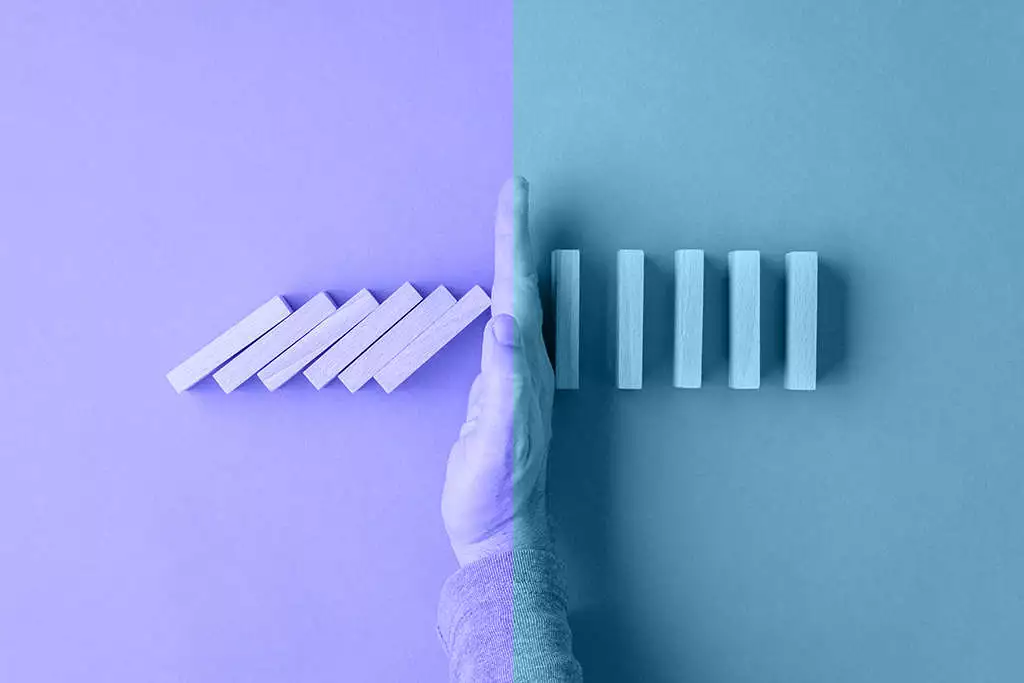

If you have not yet drafted a continuity plan that mitigates your most essential business risk, you should take on this task right away. Under the circumstances of this current crisis, you may already be living through your continuity plan, whether you have one or not. If you have a plan in place, it is recommended that you revisit it often, as aspects of your business evolve with your business growth, and how you prioritize and mitigate risk will become out of date and need a recast.

4. Look for opportunities to diversify revenue based on team strengths

While focusing on keeping the cash funnel open, you may also want to take a look at your team’s strengths and brainstorm on new ideas and innovation. Be careful not to take your attention away from all the things necessary to preserve cash and keep your lights on, but economic downturns have historically proven to be a perfect opportunity for disruptive innovation.

If you have the resources, pull your team together, and task them with this project. By empowering your team and giving them a voice to be heard, you may just be surprised to learn of the cool new ideas they will come up with. Create a safe, friendly environment for them to share ideas, collaborate with your teams internally, and establish regularly scheduled sessions for innovation review. Encourage your employees to participate by making this fun and celebrating all input, regardless of whether their ideas lead to your next great solution and additional streams of revenue (and cash).

Click here to read more on innovating during economic downturns.

The most important tip I can leave you with as our economy begins to reopen is remain positive but be diligent and proactive in obtaining and preserving working capital. The adage of ‘Cash is King’ has never been truer when times are so uncertain. Stay strong and we’ll get through this together.